VELES: Up to 70% of the agricultural vehicles in Russia need to be replaced

In an interview with RBC Krasnodar, Ivan Kharlamov, director of the Altai Agricultural Machinery Plant JSC (VELES brand), talks about demand, prices and competition in the Russian agricultural machinery market

Demand for agricultural machinery

According to your colleagues at Rosspetsmash, the demand for agricultural machinery in Russia has fallen by about 8%. Production has also experienced a negative trend, falling by around 5%. In your opinion, is this a sustainable market decline or not?

We are directly dependent on the current conditions in the agricultural market. We are now waiting for the harvest results in the different regions of the country. These are characteristic features that will show how the situation with agricultural machinery in the country will develop. We can see that there is a decline in demand, including in our factory.

Are there any other indicators that reflect the market situation?

In the first five months of this year, the overall decline in food processing was around 28%. Despite this, we are taking appropriate measures to maintain our sales volume and expand the range of products we produce and sell.

Competitiveness of Russian and foreign agricultural machinery manufacturers

What is the share of imported vehicles in the fleet of agricultural producers? What are the preferences of Russian farmers in this regard?

Russian agricultural machinery manufacturers have been given a free hand to enter the market and engage in import substitution. Now new machines are being developed and introduced that our farmers used to buy from abroad. Their quality is increasing significantly and they are becoming more competitive. According to the statistics we have, between 50% and 70% of the vehicle pool needs to be significantly upgraded. However, there is still room to make plans to strengthen positions.

Do you have data on the proportion of imported equipment?

Our segment does not keep such reports, as they are collected in fragments from customs offices and Ministry of Agriculture databases. There is no consolidated and accurate reporting.

Mikhail Mizin, a member of the board of directors of the ASKHOD Association of Agricultural Machinery Dealers, believes that prices for agricultural machinery will continue to rise due to high supply and a shortage of components. Do you share this view? If so, by how much could prices rise before the end of the year?

It all depends on how solvent our customers are. The second factor is the price environment for the raw materials and components we use in our production. As of today, the prices are back to the peak we saw during the COVID-19 years when the government had to get involved in regulating this market. This makes it quite difficult to predict whether prices will rise or fall. My guess is that they will be more or less stable in the short term.

Chinese manufacturers are now entering the Russian market. How do you assess their competitiveness? How much market share can they take?

Here we should be concerned about the arrival of large volumes of components and consumables that are mass-produced in China, but this is unlikely to happen in the next few years. The PRC simply does not produce the wide-mouth equipment used in the Russian Federation, so they will have to gain their own experience or replicate the Russian manufacturers' solutions, which takes time. I do not think that in the next 5-7 years we will see any serious competition to the tillage equipment used in Russia.

Your company's development plans

Please tell us the production and financial performance of the AZSM plant last year. What performance do you expect for 2023?

We had a very successful 2022 due to our production optimisation measures. In 2023, we plan to renew and expand the vehicle pool. We will continue to invest in ourselves by focusing on sophisticated units and improving the quality of our products. Another important goal of our company is to reduce our dependence on the human factor while increasing production volumes.

How much does the company plan to invest in modernising and expanding production in 2023? Is it much higher than in previous periods?

I think these figures will be comparable to those of 2022. The amount that we have now formalised and actually put into projects is about 60 million roubles.

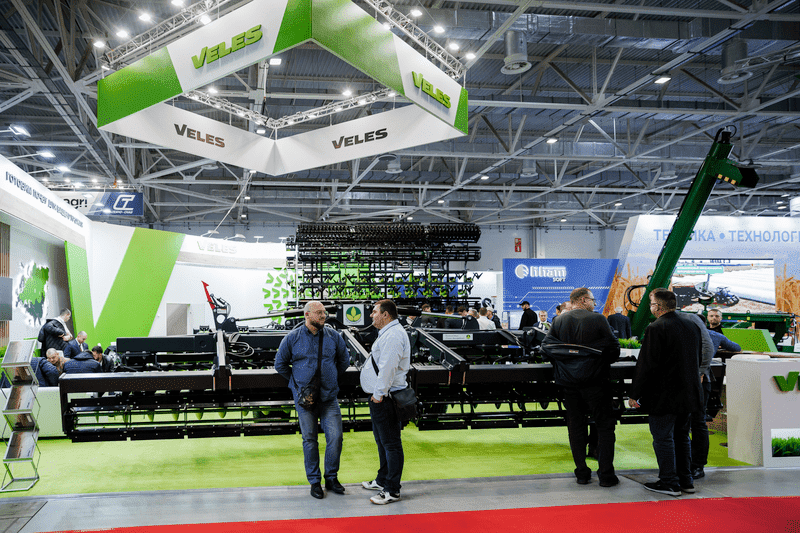

About participation of the plant in the YugAgro trade show

In November of this year Krasnodar will host the International Agricultural Trade Show YugAgro. How important is this promotional format for your company?

It's an interesting trade show that we always attend. A large part of our customers who do business in Kuban are here. We know that it is not only the regions of Southern Russia, but representatives from almost the whole country. Participation in YugAgro is very important for us as it has proven its effectiveness.

30th YugAgro International Trade Show of Agricultural Machinery, Equipment and Materials for Crop Production will be held on 21-24 November 2023 at the Expograd YUG Exhibition Venue (Kongressnaya str. 1, Krasnodar).

Rostselmash is the general partner of the Exhibition

ROSAGROTRADE is the general sponsor of the Exhibition